Assessing Operational Risk Remotely – The New Norm for Healthcare Lenders

27 May

Nationwide, COVID-19 is impacting the day to day operations of all organizations in one form or another. For some businesses, like those who lend money to nursing home operators, its impact has heightened awareness and caused greater focus on the risks associated with providing quality care to such a vulnerable population. Demand for funding continues but loan approvals and terms will further require borrowers to demonstrate their commitment to quality of care. This scrutiny is a challenge on its own, but now given social distancing requirements, keeping deals moving means lending companies must conduct a more thorough risk assessment of clinical operations and do it remotely.

Even before COVID-19 required us to work virtually, one of the biggest challenges for lenders was assessing the strength of facility leadership and their ability to maintain quality of care. For those of us who are financial-minded and understand the highly regulated business of providing nursing home care, we are keenly aware that aside from staffing shortages, the most unpredictable and challenging part of successfully operating a nursing home is dealing with the annual inspection survey and family complaint calls. Like it or not, the standard measure for quality of care is survey results and the most effective way to shield the home from financial repercussions related to poor care is to have a strong operator who has a capable Director of Nursing. The DON must have a solid reputation with the local Department of Health team. For this reason, the best lenders tour their borrower’s facilities to get a first-hand look and feel for the operation because understanding this connection is how smart lenders consistently pick the right operators and the right deals. They know that a huge part of the success of the deal comes down to effectively managing the care needs and concerns that flare up during the normal course of everyday business operations.

So with COVID-19 restrictions in place, how can you get a feel for key leadership capabilities without visiting the home? Luckily, you can turn to data. There is no shortage of quality of care data currently being collected from all nursing homes nationwide by the Centers for Medicare and Medicaid (CMS). Experienced lenders are always looking for ways to get more meaningful advance intel to ask the right questions to the right leaders.

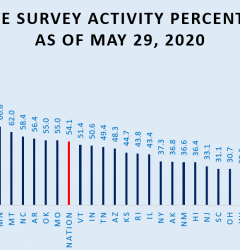

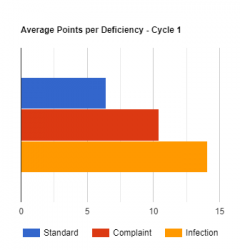

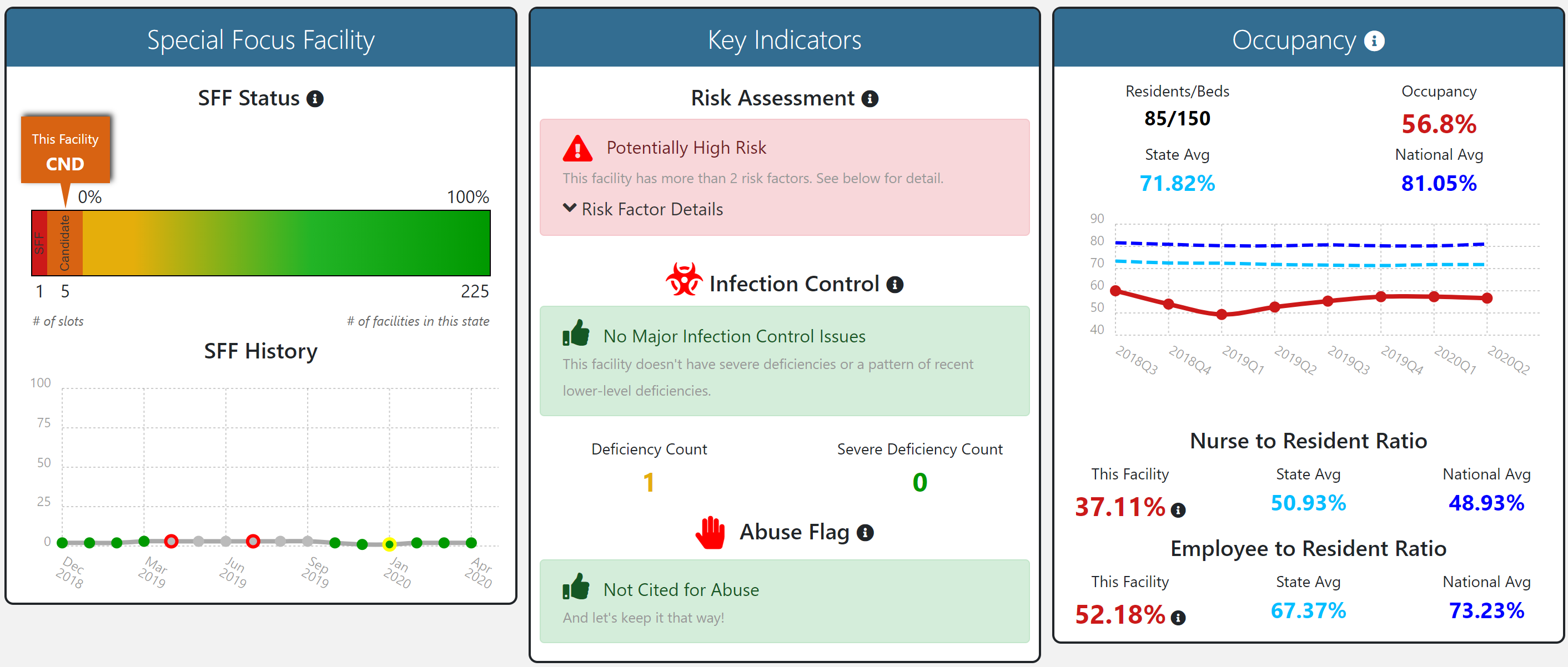

Gathering key data on-line and trending it allows lenders to gauge performance of top leadership over time and within different markets. Smart lenders analyze three-year trends in star ratings, survey outcomes, fines, denials of payments, staffing levels and occupancy levels to get a deeper understanding of a home’s story. If a facility exhibits high risk scenarios such as consistently poor surveys or not coming into compliance, the state has the power to: ban the facility from taking new admissions; fine the facility; recommend the facility be placed on the dreaded special focus facility list or even shut it down. Lenders don’t have time for surprises and using technology that trends care compliance data saves valuable research time by making everyone aware of critical issues that could derail or compromise a deal.

Stay In Touch

Sign up for our newsletter to get the latest updates, insights and analysis from the StarPRO team